Source:money.cnn.com/2009/01/07/magazines/fortune/colvin_managing.fortuneThis recession is different from the previous ones:

- Most immediately significant, employment is plunging more steeply than in a long time - by more than two million jobs last year, more than during the previous two recessions, and this one is far from over.

- At the same time, U.S. consumer spending is falling sharply. In the third quarter it sank at a 3.1% annual rate, the steepest decline since 1980 - meaning that managers who have made it through the past four recessions have never confronted anything like it. The drop is worrisome because consumer spending is more than 70% of America's economy, and while it may rise quickly or slowly, it almost always rises. During the whole of the last recession (2001), consumer spending never declined at all; its growth only slowed.

- Compounding the problem, consumers are more deeply in debt than ever, an immediate concern for companies that lend to consumers. Longer term, consumers' balance sheets are so ugly that many executives believe this recession may linger as people slowly rebuild their finances. "It could be a couple of years before consumer spending goes up again."

- Consumers aren't the only ones deleveraging. Companies are too, and on a more massive scale than ever seen before. That means business-to-business firms are also suffering.De-leveraging is typical in a recession, but because boom-time leverage had reached unprecedented levels, the reverse process may become particularly violent.

- Yet another important difference - the credit crunch - affects even those companies that are reducing debt, but especially those that aren't. Virtually all firms depend on a constant flow of credit to carry them smoothly through the ups and downs of business fluctuations. While it's entirely typical for lenders to get more cautious in a downturn, the near freezing of credit is something else again. Even companies able to pay higher interest rates may find that credit isn't available from the usual sources at any price.

The U.S. housing bubble bursts, pushing U.S. consumer spending down, leading to less demand for imports from China, causing slower growth of the Chinese economy, thus decreasing demand for copper, pushing copper prices down to their lowest levels in almost three years, causing big problems for you and your warehouse full of copper.

You can conduct pretty fancy scenario planning and still not be ready for that - and it's safe to say we've barely begun to see the rippling effects of a recession in an information-based, truly international economy.

The most effective moves you can make for prospering through a recession are ones you established a long time ago. In times like these the strong get stronger and the weak get eaten. --> while Washington Mutual and IndyMac Bank were failing, Bank of America (BAC, Fortune 500) - which got out of subprime mortgages in 2001 - attracted $21 billion of new consumer deposits as consumers ran to safety. --> When the Wickes furniture retailing chain filed for bankruptcy earlier this year, more than 100 truckloads of furniture were on their way to its stores; a Milwaukee retailer that had remained financially solid, Steinhafels, bought the contents of several at bargain prices.

10 recommendations.

- Reset priorities to face the new reality.

- Keep investing in the core.

- Communicate like crazy, balancing realism and optimism.

- Your customers face new problems, so give them new solutions.

- Don't rush to cut prices.

- Focus on capital - how you're getting it and where you're using it.

- Reevaluate people - and steal some good ones.

- Reexamine compensation - what is it offering incentives for?

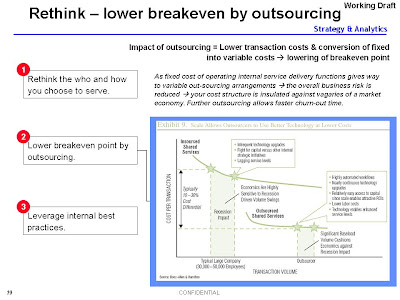

- Think twice about offshoring.

- Be smart about mergers and acquisitions.

Source: money.cnn.com/2009/01/26/smallbusiness/health_cure.fsb/index.htm

Impact of rising HealthCare premiums has been sever on small businesses is severe. -->

- Small businesses typically pay 18% more for health insurance than big companies, which can use their purchasing power to drive down the cost of coverage, according to a study by the Commonwealth Fund, a health policy research foundation.

- And the number of small firms that provide health insurance to their employees has been shrinking every year: 59% in 2007, down from 68% in 2000, according to the Kaiser Family Foundation.

- Of the 46 million uninsured in the U.S., 27 million are small business owners, their employees or their dependents.

Rich Gallo says he can't afford to provide health insurance for his nine employees. For a long time he put off buying insurance for himself, figuring he needed time to shop carefully. - Medical care related to Gallo's heart attack cost $200,000, which was paid by the state welfare department, a foundation affiliated with the hospital, and donations from Gallo's church.

Trends in Insurance Cover

- Premiums on group policies have soared by as much as 30%, on top of double-digit increases in each of the past five years.

- Coverage is shrinking.

- Due to insurer consolidation, policy choices are more limited than ever.

- And in a seller's market for insurance, small business owners have little room to negotiate prices or terms.

The escalation of the health-care crisis couldn't come at a more difficult time. Sales and profit margins are dwindling amid a weakening economy and a credit crunch.--> As a result, companies can no longer pass higher health-care costs on to their customers.

Many small busines owners are wrestling with tough issues such as --> "Do they lay off some workers in order to provide coverage for the rest?"

Policymakers will probably exercise caution in changing a system (HealthCare) that accounts for 16% of the U.S. economy. Many powerful interests will have their say in crafting legislation, including (but not limited to) insurers, state regulators, doctors and the drug industry.

Proposals range from

- eliminating employer-based health insurance and requiring all Americans to buy plans through state-run agencies, to

- lowering the cost of insurance by allowing employers to join insurance associations that pool risk across state lines.

"Insurance costs are a big disincentive to an entrepreneur."

Some innovative ways to cover themselves and their employees:

- With soaring monthly premiums, the company along with its broker engaged in a complicated dance they call the shuffle. It involves switching insurers almost annually to qualify for low introductory premiums. Cole does get lower premiums - he's had eight insurers in the last 10 years - but at a price: He spends six to eight hours each fall filling out new insurance forms.As monthly premiums climbed the employer switched to a policy that primarily covers medical catastrophes - but there's a catch. Some ailments are and medical problems are considered pre-existing conditions and aren't covered under the policy.

- In some states small firms have banded together to qualify for lower group rates on insurance. In Cleveland, for example, companies with 500 employees or fewer can buy health insurance through the Council of Smaller Enterprises (COSE), the partner of the regional chamber of commerce. Rates are about 8% lower than on the open market. Some 14,000 companies participate in the pool, which dates back to the 1980s. But Cleveland's experiment has not been widely imitated. Pools are difficult to organize and costly to administer. And insurers are less motivated to participate now that there's less competition in the industry.

- Insurance woes are forcing many entrepreneurs to rethink their business plans. By enrolling in one course (university course) each semester, the employer (individual) is qualified for low-cost student health insurance with an annual premium of $4,000 and a deductible of $250. (Her annual tuition bill is $2,200.)

- A content creating company has moved from full time employees to freelance contractors.

- Many small firms impose long waiting periods before new hires become eligible for health coverage.

- For highly skilled workers (woodcutters, artisdans, carpenters etc...) some small businesses pay out of pocket for medical costs. Employers who buy health insurance can pare costs in several ways.

- Some pressure employees to switch to generic drugs, take preventive measures during flu season, and limit doctor visits for colds and other minor maladies. Others have tried to lower insurance costs by putting a price on vice - penalizing unhealthy behavior such as smoking and overeating. Sixteen percent of the nation's largest employers make workers who smoke contribute more than nonsmokers to cover health-insurance premiums, according to Mercer, a global human resources consulting firm.

"People put pedometers on their dogs to log mileage and did all sorts of crazy things to win the prizes - anything but exercise or lose the weight," says Doug Short, CEO of BeniComp, which crafted the cost-reducing plan for Independent Alliance. "Now people have to take responsibility for their health."

Anecdotal evidence aside, it's unclear that wellness programs make a major dent in health-care costs. And despite the increasing popularity of this approach, it has another downside:

TMI - That's "too much information" - about workers and their private lives. Some business owners confess they are uncomfortable discussing personal health issues with workers or sponsoring contests that require embarrassing weigh-ins reminiscent of The Biggest Loser.